52+ who is responsible for reverse mortgage after death

The proceeds from the sale of the house are used to pay off the. Web What happens to a mortgage when someone dies.

Hmw Conference Proceedings 2013 By Te Kotahi Research Institute Issuu

When a borrower dies the executor of their estate is responsible for notifying the mortgage company.

. Ad Compare the Best Reverse Mortgage Lenders. Web Reverse mortgage foreclosure timeline Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due. The executor you name in your will becomes responsible for settling your.

Web Usually borrowers or their heirs pay off the loan by selling the house securing the reverse mortgage. For Homeowners Age 61. The couple jointly owns the home and completed the reverse mortgage.

There is a timeline within which heirs must make decisions regarding the estate. Web If you and your spouse have a mortgage on a property thats owned jointly as we mentioned earlier the responsibility of making payments on the mortgage will just fall to. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

Connect with a reverse mortgage lender now to see if you qualify with a free consultation. Web If one borrower dies the co-borrower will be able to remain in the home and receive loan payments as long as they meet the obligations of the reverse mortgage loan. Ad If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Web A reverse mortgage is for homeowners age 62 or older who want to tap into their home equity without selling the house or making monthly payments. Web If there was a reverse mortgage on the property the loan amount becomes due after the death of the borrower. Web If you are a co-borrower you can remain in the home and receive reverse mortgage payments.

Web When you and any co-borrower s or an eligible non-borrowing spouse as applicable have passed away your reverse mortgage loan becomes due. When you pass away your mortgage doesnt suddenly disappear. Looking For Reverse Mortgage Scheme.

Web Reverse mortgage borrowers should contact their lender as soon as they know who will be settling their affairs give the lender written authorization to communicate with their heirs. Beneficiaries are given 30. However whether or not they can.

A HECM is a. Its a good idea to check with your reverse mortgage servicer to make sure your loan. For Homeowners Age 61.

Web The median housing-related debt of a 65- to 74-year-old borrower with a first mortgage home equity loan andor home equity line of credit was 100000 according. For Homeowners Age 61. Web Fittingly for this topic the word mortgage is drawn from a French term for death pledge.

Get A Free Information Kit. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Home Equity Conversion Mortgages HECMs are the most common types of these types of loans which must be paid off after the last borrower or eligible spouse.

Ad Should You Get A Reverse Mortgage On Your Property. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Search Now On AllinsightsNet.

Ad An Overview Of Reverse Mortgage And How It Works. Web If one spouse has died but the surviving spouse is listed as a borrower on the reverse mortgage he or she can continue to live in the home and the terms of the loan. Web For example anytime a homeowner dies with a reverse mortgage in place the lender must formally notify the heirs that the loan is due.

1 The loan and. Get A Free Information Kit. Ad Compare the Best Reverse Mortgage Lenders.

Web Reverse mortgage heirs responsibility for a HECM loan depends on a few factors. Web With most married couples a reverse mortgage after death is fairly straightforward. For Homeowners Age 61.

If the heir to the home wants to retain the property. Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Reverse Mortgage After The Death Of A Spouse The term reverse mortgage usually refers to a Home Equity Conversion Mortgage HECM.

Looking For Reverse Mortgage. If you are not you must pay off the reverse mortgage within 30. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust. Web The answer is basically that your debts become your estates responsibility when you die. Web Partners or spouses not listed as co-borrowers may have to repay their loved ones reverse mortgage following their passing.

Reverse Mortgage Realities The New York Times

Tuesday 17th July 2018 By Thisday Newspapers Ltd Issuu

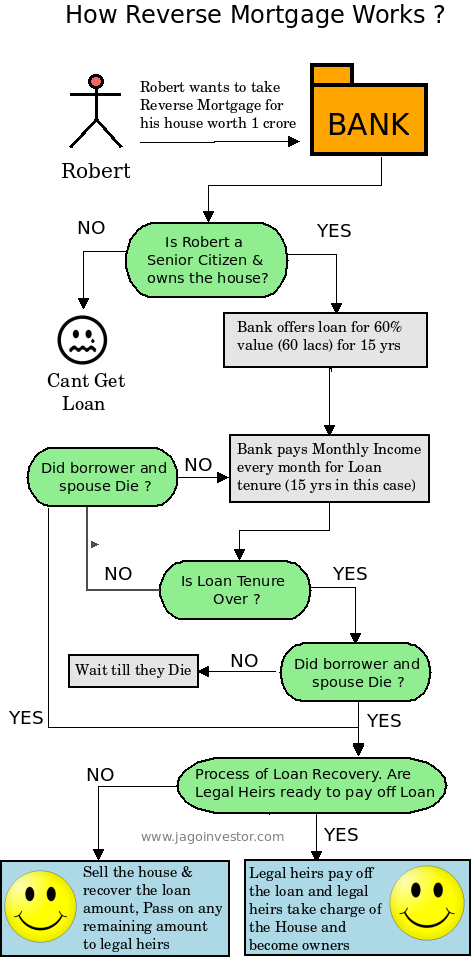

What Is Reverse Mortgage And How It Works

G881415 Jpg

What Happens To A Reverse Mortgage When The Owner Dies Goodlife

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

What Is A Reverse Mortgage The A Z Guide By Arlo

Calameo Wallstreetjournal 20160113 The Wall Street Journal

Reverse Mortgage After Death What Heirs Family Must Know

Reverse Mortgage Heir S Responsibility Information Rules

Reverse Mortgage Heir S Responsibility Information Rules

What Is Reverse Mortgage How It Can Generate Income For Old People Getmoneyrich

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

What Happens To A Reverse Mortgage After Death Luvara Law Group Llc

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

A Reverse Mortgage For Retirement Planning Financial Iq By Susie Q

What Happens When Owner Dies With Reverse Mortgage Banks Com